Commercial real estate investment caused by the attention of passengers or into the Beijing market d

2015-12-27 23:36:02 ·

Core tip: in the history of the most stringent restrictions on the purchase of the policy, there is a real estate agent is expected this year, Beijing ordinary residential turnover will be at least 30%, also blocked a lot of investment channels, and now they began to look for new investment targets in the market. As shopping centers, office buildings, hotels, shops and other commercial real estate is not within the scope of regulation, commercial real estate is attracting high attention of investors, the future or will become a new growth point in the real estate market in Beijing.

Reporter visited a number of real estate intermediary agencies, the reporter saw the majority of intermediary stores are relatively deserted, according to the agency staff introduced in Beijing eight before the introduction of a period of time, to the store to consult commercial real estate business people gradually more up. Their analysis, commercial real estate warming, on the one hand is due to the expected government regulation of the residential market, in addition, and in recent years, the downturn in commercial real estate.

From 2008 to the present, Beijing's commercial real estate market can be said is experiencing a period of downturn, due to the impact of the financial crisis, in 2008 and 2009 Beijing commercial land volume is generally low, 2008 commercial land turnover accounted for 27% of the supply in 2009 accounted for only 23.5%. This is a direct result of the downturn in the industry of the whole commercial low yield.

In 2010, began with the policy of the government has introduced to suppress prices, many used to civilian residential investment funds have flowed into the commercial real estate, so that the whole market is very clear complexion, a large increase in the market demand, introduction of the "Beijing eight" will promote more investment to focus on commercial real estate.

The twenty thousand (Tsai, a commercial real estate brokerage company general manager to the reporter said, the more stringent policy issued, in this premise, the commercial real estate more attention, especially as we all know, the government is now the goal is not to the entire real estate industry to defeat, not to say harsh (Policy) is introduced in order to make house prices, for example from the price fell to 2000, it is not the purpose, it is to trade bubble squeezed out, return to normal a way, then the contrary, these hot money investment, also can not say no, because, after all, in China the investment channels is not that special.

So I think commercial real estate (), the government may also intends to make more rational investors, investors with vision gradually towards the development, because after all, commercial real estate investment, it does not affect the livelihood of the people too much, old people, and not say because of overheating investment in commercial real estate point had no room to live, so I think this is the best a direction.

However, the industry also said that commercial real estate compared to residential investment needs more professional, should not blind investment.

Lee, a commercial real estate company manager, said the new policy, the introduction of private capital will be part of the commercial real estate, but from the scale and speed of the inflow of view, we think it is still waiting to see. Folk ordinary investors to invest in commercial real estate, although the policy impact is relatively small, but the risk is relatively high, the need for more professional knowledge, blind investment in commercial real estate may not be able to benefit, or to remind the majority of investors, investment in commercial real estate must be cautious.

2011 02 18 source: CCTV

TOP-LINE NEWS

Sedant Annual Meeting 2019 in Beijing

TOP-LINE NEWS

Merry Christmas and Happy New Year 2019

TOP-LINE NEWS

Work report from apt group for the first half of 2018

TOP-LINE NEWS

Participation in “Sedant Donation”ceremony in Shimian

TOP-LINE NEWS

apt Group Invests in Most Modern Extrusion Technology

TOP-LINE NEWS

Longxi Taihu Bay Real Estate Project Phase II Open for Sale

TOP-LINE NEWS

Bernd Schäfer becomes new CEO of apt Group

TOP-LINE NEWS

Long Xi Taihu Bay Phase II opening ceremony Yao Shi Sheng Qi

TOP-LINE NEWS

Sedant Semi-Annual Meeting

TOP-LINE NEWS

Six-star Auto Dealer Award for Sedant Langfang Auto and Bazhou Auto

TOP-LINE NEWS

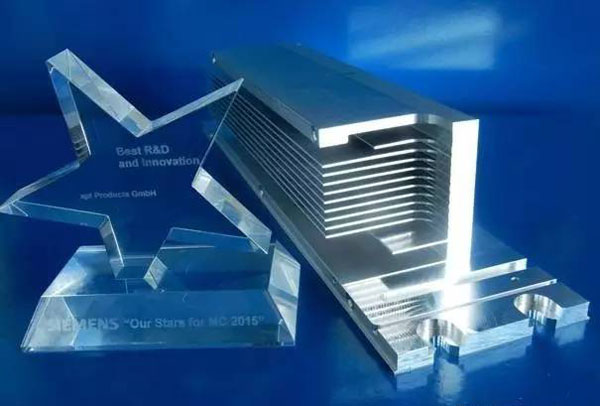

apt best supplier for R&D and Innovation

TOP-LINE NEWS

EUROPEAN ALUMINIUM AWARD for apt customer van Campen Industries

TOP-LINE NEWS

Sum-up & Commending Meeting 2016 & Mobilization Meeting 2017 of Sedant Foundation